[GTCfx]What to Expect in the Week Ahead? 26 January - 30 January

The week opens with geopolitical headlines once again. President Trump has threatened 100% tariffs on Canada if it moves forward with trade deal with China. At the same time, Senate Democrats are warning of a potential partial government shutdown over DHS funding following the Minnesota shooting. Against this backdrop, markets will also focus on the first Federal Reserve meeting of 2026, which is expected to provide guidance on the year ahead.

This Week’s Calendar

Core durable goods orders are forecast to rise by about 0.3% month-on-month. This measure is an important indicator of business investment and future production trends. A stronger-than-expected reading could signal resilient investment demand and boost market sentiment, while a weaker print may reinforce concerns about softer manufacturing activity under tighter financial conditions.

Consumer confidence is expected to be around 90.1, slightly up from December’s 89.1 but still historically subdued. Confidence readings often correlate with consumer spending, which drives roughly two-thirds of US GDP. A stronger-than-expected result would suggest households are more willing to spend, supporting growth expectations, whereas a weaker print could reinforce concerns about demand and increase expectations for policy support.

The Federal Reserve is widely expected to leave interest rates unchanged at 3.50%–3.75%. While the rate itself may not move, markets will focus closely on the Fed’s statement and Chair Powell’s press conference for clues about the future policy path. Recent inflation readings remain above the 2% target, and the unemployment rate has ticked down to 4.4%, making Powell’s commentary particularly important. His remarks could signal either a hawkish hold or a more cautious stance.

Weekly jobless claims are expected to remain near 200,000, indicating the labor market is holding up. Any unexpected rise could hint at weakening conditions. Meanwhile, US factory orders are forecast to increase by 0.5% after falling the previous month. Higher orders would suggest steady demand and support growth expectations.

Tokyo’s core CPI is expected to rise about 2.2% year-on-year, slightly below December’s 2.3%. This measure, which excludes fresh food, gives a clearer view of underlying inflation trends. A reading above expectations would suggest persistent inflation, potentially prompting the Bank of Japan to consider action, while a softer print would ease concerns and reduce the likelihood of immediate policy tightening.

Key Corporate Earnings this week

- Boeing (pre-market): Investors will watch updates on production rates and delivery schedules, as well as guidance for 2026.

- UnitedHealth (pre-market): Focus will be on revenue growth, membership trends, and outlook for healthcare costs.

- Microsoft (after market close): Markets will look for cloud growth and guidance for enterprise demand.

- Meta (after market close): Key focus will be ad revenue trends and user growth metrics.

- Tesla (after market close): Investors will track vehicle deliveries, margins, and production updates.

- Apple (after market close): Earnings will be scrutinized for iPhone sales, services revenue, and supply chain commentary.

- Visa (after market close): Market focus will be on transaction volumes, cross-border activity, and guidance for spending trends.

Technical Outlook

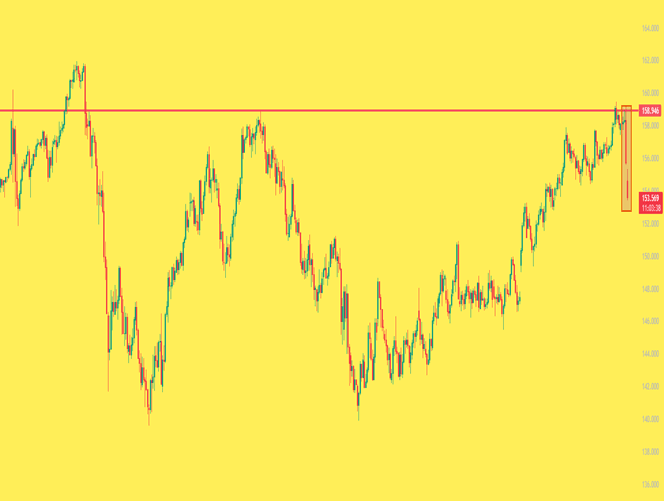

The pair dropped sharply after testing the highs from April 2024 and January 2025, confirming that bears are active above the $158 level.

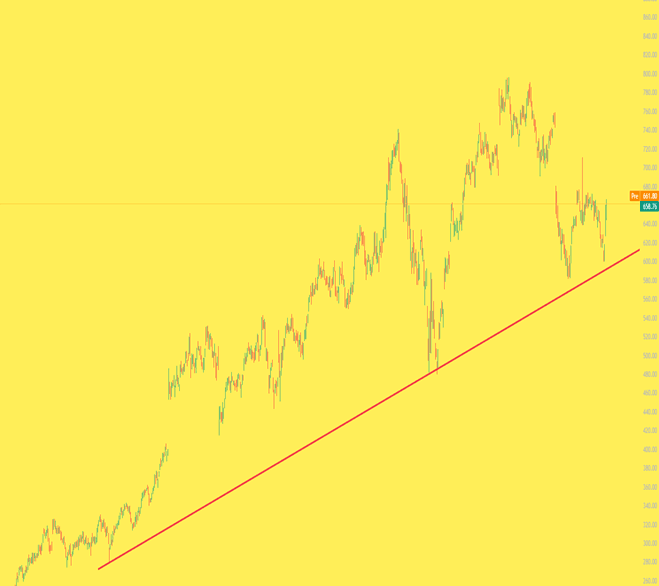

The stock is facing heavy selling pressure since the end of Q3 2025 but appears to have found support near the 600 level, which aligns with the upward sloping trendline. As long as it holds above this trend, the stock remains supported but a break below could trigger a sharp spike in volatility.

Disclaimer

The information in this article is for general information only and does not represent financial or investment advice. Markets are unpredictable, and past performance does not guarantee future results. Before making any financial decisions, please do your own research or consult a licensed financial advisor. We are not responsible for any loss or damage caused by reliance on this content.